Partnership capital for affordable housing.

We acquire, rehab, and stabilize workforce housing with disciplined operations.

Section 8 Standards, By Design.

Eight Stone Equity

Eight Stone Equity provides partnership capital for small residential assets in working-class neighborhoods. We buy below replacement cost, correct life-safety and deferred maintenance first, meet or exceed Section 8 standards, and stabilize through disciplined, data-driven operations.

What we actually buy

Small residential assets (single-family, small multifamily, scattered-site portfolios)

Value-add, tax deed / distress to stabilized

Workforce housing aligned with rent reasonableness

How we create value

Life-safety and code items addressed immediately

Targeted rehab with verified scopes and controls

Compliance-forward operations for Section 8 and local programs

Stabilization, refinance, and hold/sell based on performance

Risk management

Conservative underwriting and stress testing

Rehab controls: scope, bids, sign-offs, and draw management

Rent reasonableness and inspection pass-rate focus

Compliance tracking and documentation at every step

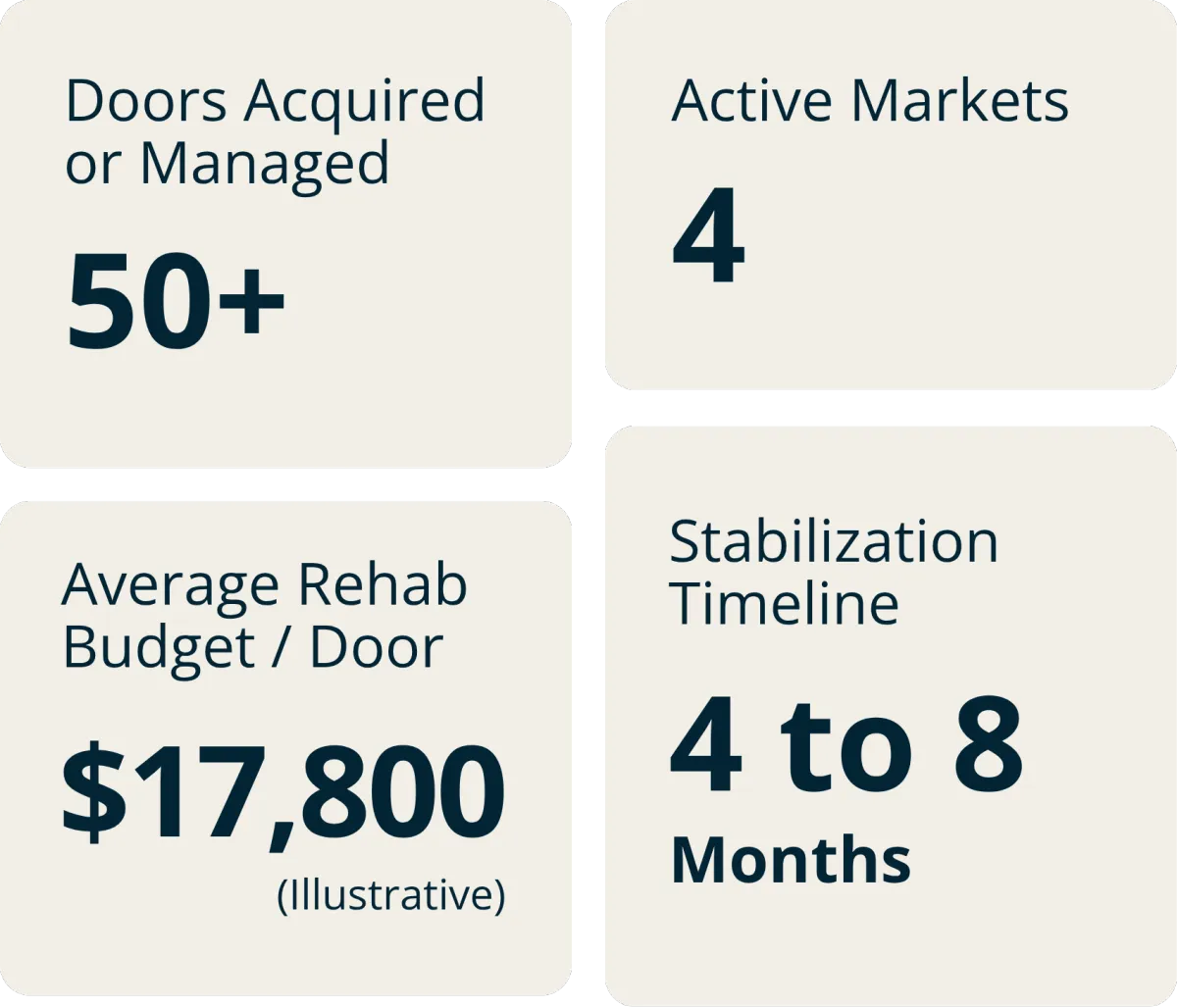

Directional stats

Track & pipeline

Illustrative metrics for directional context only and not a guarantee of future results.

Active and target markets (pins are schematic; no sensitive property addresses).

Operations Advantage

Vertically integrated operations

Eight Stone Equity partners with Midwest Strategic Solutions as our dedicated operator. Together we align capital and execution under one roof—speed, accountability, and predictable outcomes.

Vendor network with standardized scopes and pricing frameworks

Inspection readiness and pass-rate focus (HUD/Section 8 and local standards)

Cost controls with draw schedules, photo evidence, and sign-offs

Centralized compliance documentation and audit trails

Our Mission

Solving the Affordable Housing Gap

At Eight Stone Equity, our mission is to help solve the affordable housing crisis—one property at a time.

We specialize in acquiring distressed or undervalued homes, revitalizing them to meet Section 8 standards, and providing quality housing for families in need. Every home we improve contributes to stabilizing communities, preserving neighborhoods, and expanding access to safe, affordable living.

Our goal is both impact and performance—delivering consistent returns for investors while creating measurable social good.

Our Acquisition Advantage

We source affordable properties through multiple unique pipelines—many of which are not available to the public.

Our sourcing channels include:

County tax deed auctions and distressed-asset platforms

Pre-foreclosure and probate opportunities

Off-market wholesale networks across multiple states

Long-term partnerships with banks, municipalities, and housing authorities

These channels allow us to buy below replacement cost, rehab efficiently, and bring properties back into circulation for long-term Section 8 tenants.

Building a Section 8 Portfolio

Our focus is on building a large-scale Section 8 portfolio across key Midwest markets—targeting homes that can generate steady income while serving the community.

Each property goes through a standardized acquisition and rehab process, ensuring safety, compliance, and long-term stability. We work closely with local Housing Authorities to meet all HUD standards and pass initial inspections quickly.

By combining technology, field operations, and dedicated management teams, we create a repeatable system to scale affordable housing efficiently.

Our Process (Investor-Friendly)

We’ve designed a turnkey process for investors:

Acquire undervalued assets below replacement cost

Rehab to safety and compliance standards

Stabilize with long-term tenants and Section 8 approvals

Refinance or Hold for cash flow and appreciation

Investors receive transparent updates, photos, and financial reporting at each milestone.

About Us

Meet the Mind behind the Work.

Anthony Bennett

Co-Founder & Managing Partner

Anthony brings extensive experience in real estate acquisitions, capital structuring, and operational management. He oversees deal sourcing, financial underwriting, and investor relations. Focused on affordable and workforce housing, Anthony leads the company’s strategy to acquire below replacement cost, execute disciplined rehabs, and stabilize for long-term value.

Key Areas: Deal sourcing, partnerships, underwriting, compliance, and investor communications.

Philosophy: Build responsibly, protect capital, and improve communities through sustainable investments.

Anthony Bennett

Co-Founder & Managing Partner

Anthony brings extensive experience in real estate acquisitions, capital structuring, and operational management. He oversees deal sourcing, financial underwriting, and investor relations. Focused on affordable and workforce housing, Anthony leads the company’s strategy to acquire below replacement cost, execute disciplined rehabs, and stabilize for long-term value.

Key Areas: Deal sourcing, partnerships, underwriting, compliance, and investor communications.

Philosophy: Build responsibly, protect capital, and improve communities through sustainable investments.

Eric Elegado

Co-Founder & Operating Partner

Eric leads project execution, property stabilization, and construction oversight. With a background in large-scale rehab and value-add projects, he ensures each property meets HUD and Section 8 compliance standards. His operational expertise drives quality control, cost efficiency, and rapid turnaround.

Key Areas: Construction management, vendor oversight, quality control, and Section 8 compliance.

Philosophy: BFix life-safety first, stabilize efficiently, and protect long-term performance.

Contact

Request information

We welcome inquiries from private lenders, institutions, family offices, and JV partners. Provide your details below and our team will follow up. Submissions are for discussion only and are not an offer to sell securities.

Eight Stone Equity

Ready to discuss alignment?

We partner with private lenders, institutions, family offices, and JV operators to acquire, rehab, and stabilize workforce housing with disciplined, compliance-first operations.

Conservative underwriting with verified scopes & draws

Section 8 standards and inspection pass-rate focus

Operator tie-in: Midwest Strategic Solutions

Conservative underwriting with verified scopes & draws

Section 8 standards and inspection pass-rate focus

Operator tie-in: Midwest Strategic Solutions

Submissions are for discussion only and not an offer to sell securities.

COMPANY

SUPPORT

LEGAL

FOLLOW US

© Copyright 2025 Eight Stone Equity. All Rights Reserved | Disclaimer · Terms & Conditions